#financial markets and investments

Explore tagged Tumblr posts

Text

Discord Servers For Investments And Stock Training

Discord servers for investment and stock training are an essential tool for anyone looking to improve their knowledge of the stock market. These platforms offer a sense of community, flexibility, and interactivity that cannot be found in traditional educational settings.

DISCORD SERVER OVERVIEW

Discord is a platform for communication that was first created for players or gamers to talk while playing online games. Yet, over time, it has developed into a well-liked forum for groups to meet and talk about a variety of things, including music, art, and money. Users can build their own servers on Discord or join existing ones, where they can communicate with other users through text, audio, and video channels.

Being able to create various channels on a server, which is one of Discord's primary features. These channels can be used for a variety of things, including general conversation, announcements, and specialised themes. It's a terrific platform for group discussions and collaborations because users may join voice channels to engage in real-time chats with other users.

Another feature of Discord is the ability to use bots, which are automated programs that can perform various functions, such as playing music, moderating channels, and providing information. Bots can be added to a server to enhance its functionality and provide a more interactive experience for users.

Click Here

#multiplayer servers#stockmarket#share trading#stock maket news#nifty news#stock trading#finance#financial markets and investments

1 note

·

View note

Text

#housing inequality#corporate ownership#home equity#affordable housing#real estate market#wealth disparity#housing crisis#single-family homes#working-class families#corporate landlords#Georgia housing market#property investment#economic disparity#housing affordability#rental market#housing market inequality#corporate real estate#wealth gap#homeownership barriers#housing investment#financial disparity#real estate monopoly#housing affordability crisis#rental housing#economic inequality#property ownership#housing accessibility#corporate influence#affordable homeownership#investment firms in real estate

1K notes

·

View notes

Text

{ MASTERPOST } Everything You Need to Know about Retirement and How to Retire

How to start saving for retirement

Dafuq Is a Retirement Plan and Why Do You Need One?

Procrastinating on Opening a Retirement Account? Here’s 3 Ways That’ll Fuck You Over.

Season 4, Episode 5: “401(k)s Aren’t Offered in My Industry. How Do I Save for Retirement if My Employer Won’t Help?”

How To Save for Retirement When You Make Less Than $30,000 a Year

Workplace Benefits and Other Cool Side Effects of Employment

Your School or Workplace Benefits Might Include Cool Free Stuff

Do NOT Make This Disastrous Beginner Mistake With Your Retirement Funds

The Financial Order of Operations: 10 Great Money Choices for Every Stage of Life

Advanced retirement moves

How to Painlessly Run the Gauntlet of a 401k Rollover

The Resignation Checklist: 25 Sneaky Ways To Bleed Your Employer Dry Before Quitting

Ask the Bitches: “Can I Quit With Unvested Funds? Or Am I Walking Away From Too Much Money?”

You Need to Talk to Your Parents About Their Retirement Plan

Season 4, Episode 8: “I’m Queer, and Want To Find an Affordable Place To Retire. How Do I Balance Safety With Cost of Living?”

How Dafuq Do Couples Share Their Money?

Ask the Bitches: “Do Women Need Different Financial Advice Than Men?”

From HYSAs to CDs, Here’s How to Level Up Your Financial Savings

Season 3, Episode 7: “I’m Finished With the Basic Shit. What Are the Advanced Financial Steps That Only Rich People Know?”

Investing for the long term

When Money in the Bank Is a Bad Thing: Understanding Inflation and Depreciation

Investing Deathmatch: Investing in the Stock Market vs. Just… Not

Investing Deathmatch: Traditional IRA vs. Roth IRA

Investing Deathmatch: Stocks vs. Bonds

Wait… Did I Just Lose All My Money Investing in the Stock Market?

Financial Independence, Retire Early (FIRE)

The FIRE Movement, Explained

Your Girl Is Officially Retiring at 35 Years Old

The Real Story of How I Paid off My Mortgage Early in 4 Years

My First 6 Months of Early Retirement Sucked Shit: What They Don’t Tell You about FIRE

Bitchtastic Book Review: Tanja Hester on Early Retirement, Privilege, and Her Book, Work Optional

Earning Her First $100K: An Interview with Tori Dunlap

If you found this helpful, consider joining our Patreon.

#personal finance#saving money#retirement#saving for retirement#retirement account#retirement fund#401k#FIRE movement#early retirement#financial independence#investing#stock market#investors

76 notes

·

View notes

Text

16 notes

·

View notes

Text

"Fuel your financial journey with the power of US stocks! 🚀 Don't just watch, be a part of the wealth revolution! 📈 Join my dynamic stock investment group, where opportunities ignite, insights flourish, and success awaits. Seize the moment, let's rewrite the story of your financial triumph together! 💪💼

#financial literacy#financialfreedom#finance#financial#economy#ecommerce#investors#investing#invest#stock market#stocks#stock#real estate#investor#self love#encouragement#encourage#selfworth#manifest#growth#grow#improvement#motivation#motivatedmindset#mindset#growthmindset#improve#quote#quotes#inspirational quotes

57 notes

·

View notes

Text

Stock recommendations

Recommended index: ⭐️⭐️⭐️⭐️⭐️ Stock name: FOXO Purchase price: $0.49 First target: $0.8 Second target: $1 Expected increase: 40%~90% Recommended investment portfolio ratio: 60%

7 notes

·

View notes

Text

youtube

Benzinga Interviews NVSTly: The Future of Social Investing

Join Benzinga as they sit down with NVSTly, the cutting-edge platform revolutionizing social trading and investing. In this exclusive interview, NVSTly shares insights on empowering retail traders, fostering transparency, and building a thriving community for investors of all levels. Discover how NVSTly is shaping the future of trading with innovative features, real-time trade tracking, and global collaboration.

Join NVSTly:

Website: nvstly.com

Mobile App: Available on Google Play and App Store

Discord Community: Join Now

#crypto#cryptocurrency#finance#fintech#forex#futures#investing#investors#stock market#startup#business#Youtube#stocks#nasdaq#financial#investing stocks#investment#blockchain#personal finance#finances#economy#economic#forextrading#forex market#futures trading#stock trading#markets#invest#awards#award winning

4 notes

·

View notes

Text

The 40 - A good investment

----

@the-ravenclaw-werewolf and @purplemochi20055

----

"An investment in knowledge pays the best interest." - Benjamin Franklin

----

I'm back again with another daily drabble of The 40. (Encouraging the completion of the final chapter of Main Character Syndrome (With Exceptions))

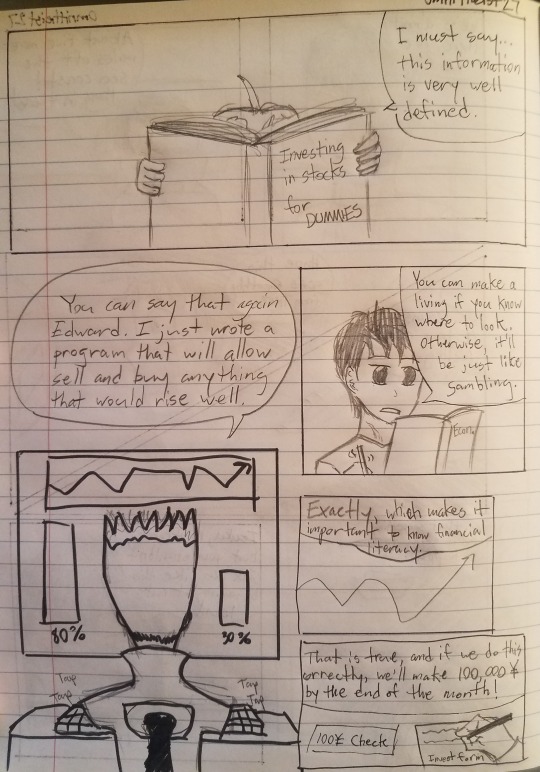

After going through some investments I made in Robinhood.com while trying to find a job, I decided to apply my woefully illiterate financial knowledge to the characters of The 40 by having an OC give them a challenge involving a loan of a ¥100 check.

The challenge? Use the ¥100 check and raise up to ¥100,000 in the stock trade by the end of the month.

Edward and Haruhi are woefully unknown to the Japanese stock trade, they are hitting up the books in the library regarding business and economics, and learning at a fast pace while simultaneously interested in the financial subjects. While Senku and Kobayashi started investing the ¥100 check into stocks.

To raise ¥100,000 in such a short time, the four members of The 40 traded like crazy. Many days went by as they loaded themselves with free caffeine to keep their eyes glued to the rise and fall of the stock trade, adding a certain level of stress.

To help ease things, Senku and Kobayashi both wrote their own computer programs using the library's computers that can track trends, analyze data, and automatically invest in something that would profit.

By the end of the month, the four of them managed to earn themselves good fortune that not only paying back the ¥100,000 and having a good amount of paper currency for themselves, but also gaining some great financial experience and literacy.

----

Speaking of money, I think it's a good time for me to start doing the "tipping" feature of Tumblr to earn some side income for my artwork.

Just click on the "tip" icon below for more of my drawings!

#the_40#fan comic#crossover#stock market#investing stocks#financial literacy#fullmetal alchemist#dr. stone#ouran high school host club#miss kobayashi's dragon maid#edward elric#ishigami senku#haruhi fujioka#kobayashi#daily encouragement#monetization

14 notes

·

View notes

Text

#day trading#futures trading#investing#investors#investments#finance#personal finance#financial literacy#volumeprofile#marketprofile#order flow#trader#stock market#emini

11 notes

·

View notes

Text

I am very much a bargin bin collector and just follow market prices so I know when something I find is a good deal. I could hardly ever afford anything over a few hundred dollars even saving up for a while (at the end of the day I still prefer to save money for practical expenses and emergencies), but I like to think outside the box and find more obscure but nice quality pieces or broken/damaged stuff I can restore or have restored. It's helped a ton for getting nice pieces within my budget and I feel like my collection is more "me" because it's not the big show pieces but a lot of little things that add up to to one big curated collection with a lot of extra love in it.

#that plus just being a collector for 30 years and knowing a ton of cool friends and sellers who've helped me get a lot of awesome stuff#like it's a labor of love for sure#I love sharing my collection but I'm not wealthy by any means#I collect a lot of generally cheap stuff plus some bigger pieces sprinkled in#but the most I've ever spent on anything non-practical was like $700 or so?#and that was still after saving for a few montns#you gotta be in it for the long haul and know your market fod good deals#the time investement is honestly more than the financial one in most cases 😭#jackal's journal

65 notes

·

View notes

Text

#forex robot#forex#forextrading#forex market#investing#finance#algo trading#forex expert advisor#invest#financial

13 notes

·

View notes

Text

The painfull learning curve

The financial markets tends to be chaotic. The fact of the matter it involves processing huge flow of information and then respond accordingly. This requires patience , managing your emotions and being able to learn from your mistakes.

Took this trade on EUR/USD.

Remember the patience and dicipline is the key.

#forex trading#forex online trading#forex signals#forex education#forexmarket#trader#finance#investing#markets#economy#money#financial independence

39 notes

·

View notes

Text

In the stock market, a short squeeze is a rapid increase in the price of a stock owing primarily to an excess of short selling of a stock rather than underlying fundamentals. A short squeeze occurs when demand has increased relative to supply because short sellers have to buy stock to cover their short positions.

What's a Short Squeeze and Why Does It Happen?

Key Points

A stock that rallies hyperbolically when there are no obvious current events driving the response, could be experiencing a short squeeze.

A short squeeze can potentially be worth trading, but only if you exercise great care.

The aim of short selling is to generate profit from a stock that declines in value. (Short selling involves borrowing a security whose price you think is going to fall from your brokerage and selling it on the open market. Your plan is to then buy the same stock back later—hopefully for a lower price than you initially sold it for—and pocket the difference after repaying the initial loan.) While there are potential benefits to going short, there are also plenty of risks. One big risk is when a bullish catalyst (earnings, news, technical event, etc.) pushes the stock price higher, prompting short sellers to "head for the exits" all at once. As the shorts scramble to buy back and cover their losses, upward momentum can build on itself, causing the stock to move sharply higher. This is known as a short squeeze.

Understanding the short squeeze

What makes a short squeeze so dangerous? Think of it this way: When you buy a stock, the worst thing it can do is drop to zero. But the upside is unlimited. If a stock has a growth narrative and there are enough believers, the share price can go well beyond what looks reasonable by traditional fundamental metrics.

Classic signs of a short squeeze can include:

A security has a significant amount of short sellers (short interest) who believe the stock price is going to fall, and then instead the stock price sharply rises, forcing many of these leveraged short sellers to quickly exit their positions, buying back the stock in the face of potentially increasing losses.

A dynamic narrative that tries to justify the detachment of share prices from a company's intrinsic value

A case for massive growth as well as for financial stress

Traders with deep pockets aligned on both sides of the trade, often using options and other leveraged instruments

With GameStop (GME) in 2021 and Tesla (TSLA) in 2020, there were many classic signs of a short squeeze. Traders with short positions were covering because they had to, either because they had sustained large losses or shares were no longer available to be borrowed. In 2022, short sellers targeted troubled companies such as Bed, Bath & Beyond (BBBY) and Carvana (CVNA). In early 2023, the most heavily shorted companies included Coinbase Global (COIN), a cryptocurrency firm, and Occidental Petroleum (OXY).

When a stock suddenly experiences a dramatic climb, with or without good news, it's important to ask yourself, "Who would buy shares up here?" The answer? Someone who doesn't have enough money to hold on any longer, or someone whose pain threshold has finally been crossed.

Proceed with caution

If you're a long-term investor who happens to own a stock that's getting squeezed, it's probably not a good time to trade. Instead of acting on emotions, remember what got you to where you are in your investing journey—and where you'd like to be. If buying a stock that's in squeeze territory doesn't fall within your long-term objectives, you might want to step aside and not trade. If you do decide to venture in, make sure you have no illusions and no misconceptions of the dangers. Understand that when you’re dealing with a stock that’s being squeezed, you're taking a big risk.

Identifying a short squeeze can be relatively simple—after the fact. The trick is to identify the conditions that could lead to a squeeze ahead of time, and then determine how you might want to play it (or not).

Shorting a stock is a complicated business. Because you can't sell something you don't own, shorting requires the seller to "borrow" the stock (and pay interest to the stock lender), then sell it. Locating the shares can sometimes be difficult for your clearing firm because of high demand or a small number of outstanding shares.

Measuring a short squeeze can involve a metric called the short interest ratio, a.k.a. "days to cover." It indicates, in days, how long it would take to cover or buy back all the shorted shares. Basically, you divide the number of shares sold short by the average daily trading volume. The more days to cover, the more pronounced the effect can be.

Another measure is "short interest as a percentage of float," which reflects the number of short-sold shares in proportion to the total number of shares available for trading in the public markets. Most stocks have a small amount of short interest, usually in the single digits. The higher that percentage, the greater the bearish sentiment may be around that stock. If the short % of the float reaches 10% or higher, that could be a warning sign.

Consider the fundamentals

If you're buying a stock that seems to be in the throes of a short squeeze, especially at high levels, it helps to understand other potential reasons why the stock might be moving.

Consider checking the fundamentals. Is there anything that would make you want to own the stock? Are you tempted to buy it because everyone else is? It's important to always do your homework, and remember it's never wise to go all in. A stock that's in a short squeeze may still have a long way to climb, and if you don't think the fundamentals support higher prices, then perhaps you should look elsewhere.

In the case of TSLA in 2020, there were some positive fundamentals underlying the short squeeze, including the company's more consistent profitability and hopes of it being included in the S&P 500 Index (SPX). The stock saw its share price run up to new highs, then decline nearly 60%.

But then TSLA rallied again and split its shares, and its addition to the SPX became a reality, illustrating that a short squeeze doesn't always have to end badly. Other stocks that were caught up in short squeezes haven't always fared so well, in part because they didn't have the fundamental support.

Playing the squeeze on the long side?

If you want to trade a stock during what might be a short squeeze—that is, buying a stock with a higher short interest in order to potentially play the upside of a squeeze—here are some things to consider:

Trading such a stock may be okay as long as you understand the risk and how to control it. Whether you make small or large trades, you have to control and limit the risk. Decide how much money you would be comfortable losing in any trade ahead of time.

Don't underestimate how high the stock can go and how long it can take. When a stock gets caught up in a short squeeze, analysts generally expect it to correct eventually, but no one knows to what price and when; if it happens at all.

If the stock still has very weak fundamentals, yet is moving significantly higher without any real, structural changes in the corporation, then be extremely careful buying on this type of upward momentum. The markets may run out of new buyers willing to pay higher and higher prices and the stock may in the end fall quickly.

The bottom line

A short squeeze is a high-risk situation and it may cause havoc in the market, but most don't last forever. Most eventually subside.

#kemetic dreams#the big short#finance#financial#short squeeze#stocks#financialnews#investing#earningsreport#stockmarket#market#money#make money online#earn money online#make money from home#old money#millionaire#profit#finances#income

11 notes

·

View notes

Text

youtube

S4 E1: “Index funds include unethical companies. If I still invest, does that make me a monster?”

Want the transcript? We got your transcript right here!

Did we just help you out? Join us on our Patreon!

16 notes

·

View notes

Text

Hammer Candlestick: Make Reversal Opportunities

In the world of technical analysis, identifying potential market reversals is important for traders seeking to maximize their profits and minimize their losses. One of the most reliable patterns for spotting these reversals is candlestick patterns, especially hammer candlestick

What Is a Hammer Candlestick?

A hammer candlestick pattern is a specific type of candlestick pattern used in technical analysis to indicate a potential reversal in a downtrend. It appears at the bottom of a downward trend and is characterized by a small body at the upper end of the trading range with a long lower shadow. The length of the lower shadow is at least twice the length of the body. This pattern suggests that despite the sellers pushing prices down significantly during the trading period, strong buying pressure drove the prices back up near the opening price by the end of the period, indicating a possible reversal to the upside.

Types of Hammer Candlestick

Hammer Candlestick The hammer candlestick pattern appears at the bottom of a downtrend and is characterized by a small body with a long lower shadow and little to no upper shadow. The lower shadow should be at least twice the length of the body.

Inverted Hammer Candlestick The inverted hammer candlestick pattern also appears at the bottom of a downtrend but is characterized by a small body with a long upper shadow and little to no lower shadow. The upper shadow should be at least twice the length of the body.

Limitations of Hammer Candlestick

Confirmation Required: A hammer candlestick alone does not guarantee a trend reversal. Subsequent bullish price action is needed to validate it.

No Price Target: The pattern does not provide a specific price target for the potential reversal, requiring other tools for determining exit points.

Context-Dependent: The hammer pattern is most reliable at the bottom of a downtrend and may not be valid in other market conditions.

False Signals: In highly volatile markets, hammer patterns can occur frequently without indicating a true reversal.

Additional Indicators Needs: It will be more effective with other technical analysis tools, rather than relying solely on the hammer candlestick.

Learn more: https://finxpdx.com/hammer-candlestick-how-to-spot-reversal-opportunities/

5 notes

·

View notes

Text

What is Mutual Fund?

A mutual fund is a type of investment vehicle that pools money from multiple investors to invest in a diversified portfolio of securities such as stocks, bonds, and other assets. Investments in securities are spread across a wide cross-section of industries and sectors and thus the risk is reduced.

It is managed by a professional fund manager or an asset management company (AMC) who makes investment decisions on behalf of the investors.

Mutual funds offer good investment opportunities to the investors. Like all investments, they also carry certain risks

SEBI formulates policies and regulates the mutual funds to protect the interest of the investors.

OVERVIEW OF MUTUAL FUNDS INDUSTRY IN INDIA

The mutual fund industry in India was set up through a combination of regulatory changes, legislative reforms and the entry of various market players.

Unit Trust of India- UTI was founded in 1964, which is when the mutual fund sector in India first started to take off. To mobilize public funds and invest them in the capital markets, UTI was established as a statutory body under the UTI Act, 1963. The idea of mutual funds was greatly popularized in India because to UTI.

Regulatory Framework-In India, the mutual fund industry's regulatory structure began to take shape in the 1990s. The Securities and Exchange Board of India (SEBI) Act, which established SEBI as the governing body for the Indian securities markets, was passed in 1993. Among other market intermediaries, SEBI was responsible with regulating and supervising mutual funds.

The SEBI (Mutual Funds) Regulations,1996- This regulation established the legal foundation for the establishment, administration, and operation of mutual funds in India. These regulations outlined the standards for investor protection, investment restrictions, disclosure requirements, and eligibility requirements for asset management companies (AMCs).

Introduction of Private Sector Mutual Funds: UTI was the only active mutual fund provider in India prior to 1993. Private sector mutual funds were nevertheless permitted to enter the market as a result of the liberalization of the financial sector and the opening up of the Indian economy. Many domestic and foreign financial organizations launched their own AMCs and entered the mutual fund industry.

Product Line Evolution: The mutual fund sector in India has grown and increased its product selection throughout the years. Mutual funds initially mainly offered income and growth opportunities. To address various investor needs and risk profiles, the industry did, however, offer a wider range of products, such as equity funds, debt funds, balanced funds, and specialist sector funds.

Investor Education and Awareness: Serious efforts have been made to educate and raise investor awareness in order to encourage investor involvement in mutual funds. Industry groups, AMCs, and SEBI have run investor awareness campaigns, distributed instructional materials, and supported systems for resolving investor complaints. Systematic Investment Plans (SIPs) were introduced, and this was a significant factor in luring individual investors

Technological Advancements-The mutual fund sector in India has embraced technological development, making it possible for investors to access and invest in mutual funds through online platforms and mobile applications. Investors can now transact, track their investments, and get mutual fund information more easily thanks to digital platforms.

The mutual fund industry in India has developed into a strong and regulated sector through regulatory changes, market competition, and investor-centric initiatives. The sector keeps expanding, drawing in more investors and providing them with a wide variety of investment possibilities around the nation.

#business#writing#investment#mutual funds#security market#money#sebi registered investment advisor#equity#make money tips#savings#financial#raise funds#funds#profit#return#growth#reading#knowledge#personal finance#income

42 notes

·

View notes